In some countries like Australia, England, New Zealand there are taxes on sales, normally called sales tax, GST(goods and services tax), or VAT (value added tax). The invoice system has the ability to allow the user to setup and define tax rates.

To view the default tax rates select Tax Rates under the Settings tab.

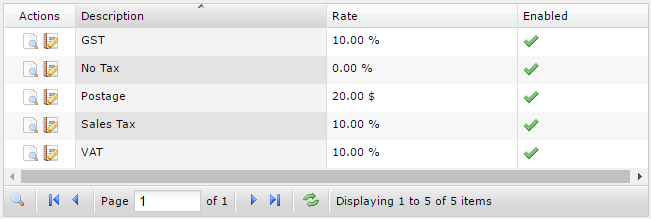

This will now display all the available tax rates in the invoice system.

To edit an existing tax rate, select the edit button under the Actions column

To add a new tax rate, select, click the Add New Tax Rate button.

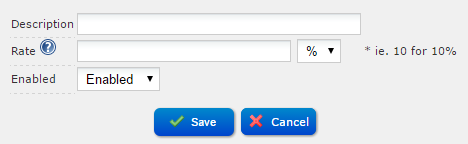

Fill in the required fields and click Save. The new tax rate will now be available when creating a new invoice.

Note: When adding or modifying a tax rate, you can either choose Enabled or Disabled . Enabled means the tax rate can be used when creating a new invoice.